Amazon reports its first quarter earnings on Tuesday. Analysts will be watching for continued growth in the company’s key profit drivers: advertising and cloud computing.

After dropping in price throughout 2022, Amazon’s stock bounced back last year and has continued to climb, trading at nearly $180/share.

The company is coming off better-than-expected results in its holiday quarter.

Generative AI boosting cloud

Analysts are expecting around 15% year-over-year in Amazon Web Services. Microsoft and Google reported cloud revenue growth of 23% and 28%, respectively, last week.

Demand for generative AI tools and services is boosting business for cloud providers.

Amazon is making an effort to appeal to AI application developers by offering access to a variety of AI models through its Bedrock managed services.

“Amazon believes generative AI cloud services will generate tens of billions of revenues in the next several years,” Wedbush analysts wrote in a recent report. “AWS remains a primary beneficiary of generative AI and the company is well positioned with solutions for all layers of the genAI stack.”

After experiencing a decline in profitability from mid-2022 to mid-2023, AWS rebounded with 29% and 38% increases in year-over-year operating profits in the third and fourth quarters of 2023, respectively.

AWS reported profits of $7.2 billion on revenue of $24.2 billion in the fourth quarter, contributing significantly to Amazon’s overall business growth.

Enterprise spending on cloud infrastructure was up 20% in the fourth quarter of last year, according to Synergy Research Group.

Ad business keep growing

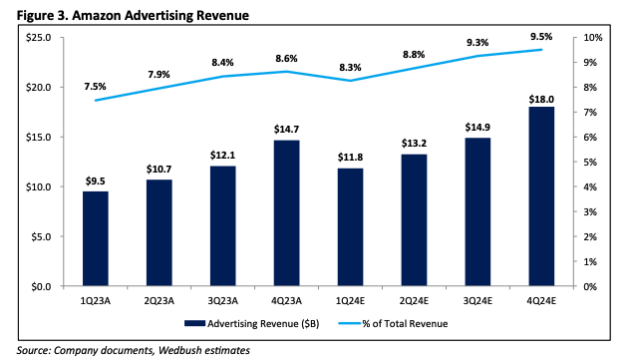

Analysts with Wedbush are bullish about Amazon’s advertising business, citing growth in retail media advertising spend (ads that appear on a company’s site or app) and the recent launch of Prime Video ads.

Results from Meta, Alphabet, and Snap last week indicate that the digital ad market is bouncing back after a rough 2022.

Advertising brought in $14.6 billion in revenue in Amazon’s fourth quarter, up 27%.

Amazon CFO Brian Olsavsky called advertising an “important part of the total business model,” on the company’s Q4 call with analysts.

Other notes

- Another area to watch: headcount. After going on a hiring spree as the pandemic drove demand, Amazon laid off 27,000 employees last year and continues to cut from its corporate workforce. Amazon employed 1.52 million people (including warehouse workers) as of Sept. 30, down 1% year-over-year.

- Wedbush analysts also pointed to recent changes in U.S. third-party seller fees which could help drive substantial revenue.

- Amazon on Monday announced that it set new records for Prime delivery speeds in the first three months of this year, touting a shift to regional fulfilment centers.

Amazon is expected to report Q1 revenue of $142.7 billion and earnings per share of $0.83. In the year-ago quarter, Amazon reported revenue of $127.4 billion and earnings per share of $0.31.