Updated with details from Microsoft’s earnings conference call.

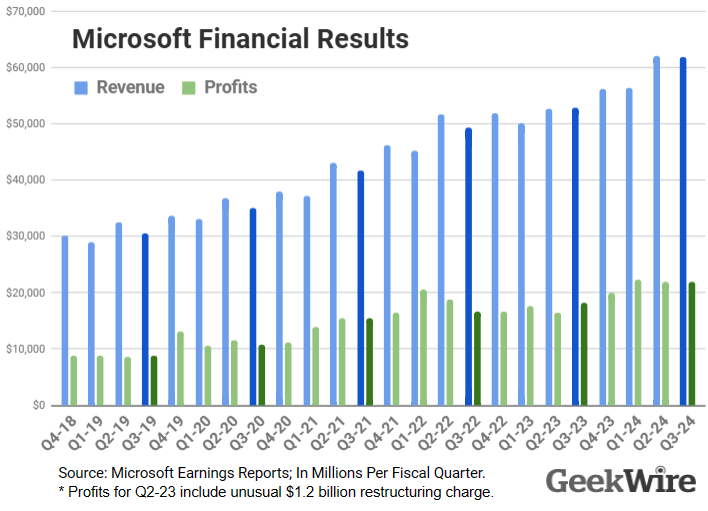

Microsoft posted a 17% increase in revenue, to $61.9 billion, with $21.9 billion in profits, up 20%, and earnings of $2.94 per share, beating Wall Street’s expectations across the board for the third quarter of its 2024 fiscal year.

The results helped to cement Microsoft’s position as the world’s most valuable company, lifting the company’s stock in after-hours trading, and provided further evidence of the potential for AI to fuel its business.

Microsoft “is seeing a new era of AI transformation driving better business outcomes across every role and industry,” said Satya Nadella, the company’s CEO, on its earnings conference call.

Nadella and CFO Amy Hood spent much of the call fielding questions about the AI demand fueling the company’s growth, and the capital expenditures needed to keep up. Microsoft spent a record $14 billion in the quarter on capital expenditures, including new data centers and computing infrastructure to train and run AI models.

“We continue to bring capacity online as we scale our AI investments with growing demand,” Hood said. She added that demand for AI is currently “a bit higher than our available capacity,” said capital expenditures will increase in the next fiscal year, and noted that the company is watching other expenses closely to avoid hurting profits.

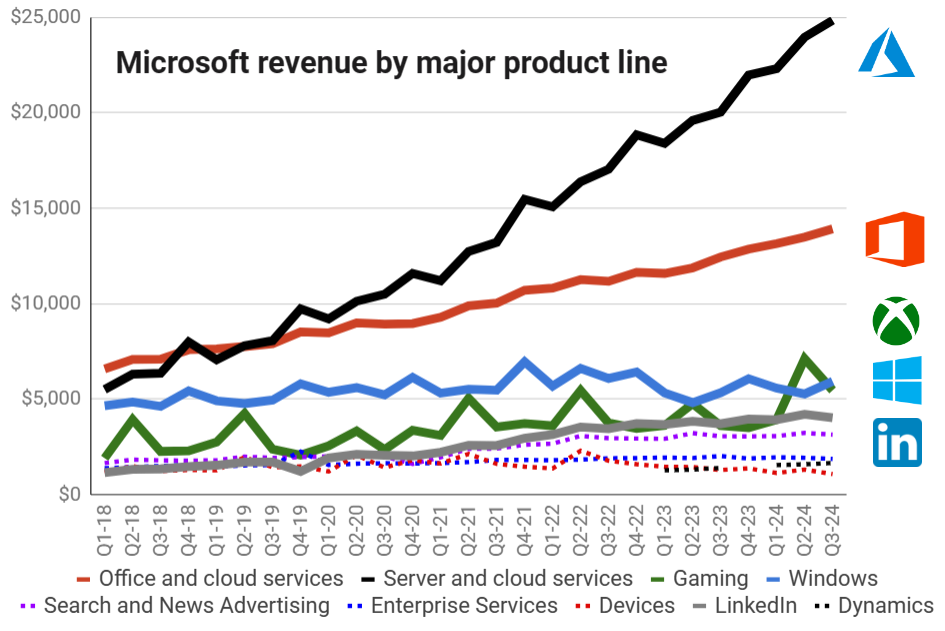

Revenue from Microsoft’s Azure cloud platform and related services was up 31%, according to the company’s earnings release. About 7 percentage points of this growth came from artificial intelligence, including Microsoft’s Azure OpenAI service, which provides access to AI models from Microsoft’s key AI partner.

Microsoft’s earnings release does not disclose the contribution to its Office Commercial product line from Microsoft 365 Copilot, its AI tool for businesses, leaving the impact of that product on its overall revenue unclear. Overall revenue from Office Commercial products and cloud services increased 13% in the quarter.

The company’s overall cloud revenue was up 23% to 35.1 billion. This includes Azure and other cloud services, Office 365 Commercial, the commercial portion of LinkedIn, Dynamics 365, and other commercial cloud properties.

Revenue was up in each of the three divisions used by Microsoft in its financial reporting.

- Productivity and Business Processes (Office, LinkedIn, Dynamics) rose 12% to $19.6 billion.

- Intelligent Cloud (Azure, Windows Server) rose 21% to $26.7 billion.

- More Personal Computing (Windows, devices, gaming) rose 17% to $15.6 billion

Devices, which includes Microsoft Surface laptops and tablets, saw the biggest revenue decline among the company’s major product lines, falling nearly 17% to slightly more than $1 billion in revenue for the quarter.

Microsoft Gaming revenue rose 51% to more than $5.4 billion, due to the Activision Blizzard acquisition.

However, a strong quarter for Windows (up 11% to $5.9 billion) moved the PC operating system back into third place among Microsoft’s major product lines after it was briefly surpassed by games in revenue in the second fiscal quarter.

In advance of the earnings release, analysts expected the company to report earnings of $2.83 per share on revenue of $60.77 billion, up more than 15% from $52.9 billion a year ago.

Microsoft’s stock rose more than 5% in after-hours trading. It remains the world’s most valuable publicly traded company with a market capitalization of nearly $3 trillion.